National Wages Council (NWC) 2022/2023 Guidelines

NATIONAL WAGES COUNCIL (NWC) 2022/2023 GUIDELINES

1. The National Wages Council (“NWC”) convened in September and October 2022 to formulate wage guidelines for the period from 1 December 2022 to 30 November 2023.

Economic Performance and Outlook

2. Based on advance estimates1, the Singapore economy grew by 4.4% on a year-on-year (y-o-y) basis in the third quarter of 2022, easing slightly from the 4.5% growth in the previous quarter. This brought Gross Domestic Product (GDP) growth in the first three quarters of the year to 4.3% y-o-y. Growth was broad-based, with the real value-added of most sectors of the economy having recovered to exceed their pre-pandemic levels.2 In line with the economic expansion, the labour market improved in the first three quarters of 2022 as resident employment grew and resident unemployment continued to ease. Retrenchments also fell to a record low. Meanwhile, labour productivity, as measured by real value-added per actual hour worked, improved by 1.5% on a y-o-y basis in the first half of 2022.

3. Due to strong external inflationary pressures, the Consumer Price Index (CPI) - All Items inflation is projected to average around 6% in 2022, higher than the 2.3% recorded in 2021. MAS Core Inflation (which excludes the costs of accommodation and private road transport) is projected to average around 4%, higher than the 0.9% in 2021.

4. The Ministry of Trade and Industry (“MTI”) has projected that the Singapore economy will expand by “3% to 4%” in 2022. While GDP growth for the rest of the year is expected to be supported by a continued recovery in aviation- and tourism-related as well as consumer-facing sectors with the lifting of border and domestic restrictions, the outlook for outward-oriented sectors has weakened due to softening external demand. At the same time, downside risks in the global economy remain significant. These include escalations in the Russia-Ukraine conflict which could worsen global supply disruptions, intensified financial stability risks, escalations in regional geopolitical tensions, and a potential worsening of the COVID-19 pandemic situation again. Looking ahead to 2023, MTI expects Singapore’s GDP growth to moderate further in tandem with the projected slowdown of the global economy.3

Wage Increases Should be Fair and Sustainable, and Based on the Flexible Wage System (FWS)

5. In line with economic growth and the improvement in labour productivity, the NWC calls on employers to reward employees with wage increases or variable payments that are fair. Employers should recognise the contributions of employees during the COVID-19 pandemic, where some employees experienced wage cuts and freezes, and supported other cost-cutting measures. At the same time, the uncertainties ahead continue to underscore the need for resilience and flexibility in wage structures. The NWC therefore also calls on all employers who have not yet done so to implement the FWS . The NWC sets out the following wage guidelines for all employers:

- Employers that have done well and have good business prospects should reward their employees with built-in wage increases and variable payments commensurate with the employers’ performance and employees’ contributions.

- Employers that have done well but face uncertain business prospects may exercise moderation in built-in wage increases, but should still reward employees with variable payments commensurate with the employers’ performance and employees’ contributions.

- Employers that have not done well may exercise wage restraint, with management leading by example. These employers should make greater efforts to improve business processes and productivity, especially by investing in upskilling their employees. Employers that have not done well but face good business prospects may also consider setting out future variable payments that are linked to appropriate business indicators.

6. The adoption of the FWS will help employers in implementing the wage guidelines above, by making full use of variable wage components. Employers that have not yet adopted the FWS, or who need to build up the variable wage components to recommended levels4, should put wage increases into variable wage components, and transfer part of fixed wages to variable wage components as needed.

7. A flexible wage structure enables employers to make quick adjustments during periods of economic uncertainty to sustain their businesses. At the same time, the FWS will provide greater job security for employees as companies can cut costs rather than cut jobs, and also allow wages to be more quickly restored in tandem with business recovery. Employers can refer to the FWS Guidebook, which can be accessed at https://go.gov.sg/fwsguidebook, for more information. Employers who need advice and support on implementing the FWS may approach the National Trades Union Congress (“NTUC”) and its affiliated unions, the Singapore National Employers Federation (“SNEF”), and the Tripartite Alliance for Fair and Progressive Employment Practices (“TAFEP”). The NWC also encourages trade associations and chambers and unions to support their members to adopt the FWS.

Pressing on with Sustained Wage Growth for Lower-Wage Workers (LWWs)

8. We must press on with the national effort to uplift LWWs so that our social compact remains strong and no worker is left behind even as Singapore progresses. In October 2020, the Tripartite Workgroup on Lower-Wage Workers (TWG-LWW) recommended a renewed Progressive Wage strategy to uplift our LWWs over this decade, in a way that maximises their employment outcomes, and is also sustainable for businesses. Since then, the first set of Progressive Wage moves has been implemented in September 2022, with the second set to be implemented from March 2023.5 To support employers as they raise the wages of LWWs, the Government has also introduced a five-year $3.5 billion Progressive Wage Credit Scheme6 to co-fund wage increases for LWWs. The scheme will soften the cost impact to business and consumers in the near term. It will also give employers time to invest in upskilling employees and improve firm-level productivity so that the wage increases are sustainable in the long term.

9. Wage Guidelines for LWWs . The NWC 2021/2022 guidelines recommended an annual range of wage growth for LWWs, with a minimum dollar quantum increase.7 These guidelines apply to all LWWs. They also serve as a reference for Tripartite Clusters in setting Progressive Wages for their respective sectors. Guided by NWC 2021/2022 recommendations, the Tripartite Clusters for the Retail and Waste Management sectors proposed Progressive Wage Model (PWM) wages that either were within or exceeded the NWC’s recommended range of wage growth for LWWs.8

10. This year, taking into account both our economic recovery and the uncertain global economic outlook, the NWC recommends the following:

- Employers that have done well and have good business prospects should provide their LWWs with a built-in wage increase at the upper bound of 5.5-7.5% of gross monthly wage[^9], or a wage increase of at least $80-$100 , whichever is higher.

- Employers that have done well but face uncertain prospects should provide their LWWs with a built-in wage increase at the lower to middle bound of 5.5-7.5% of gross monthly wage, or a wage increase of at least $80-$100 , whichever is higher.

11. The NWC also recognises that some employers continue to face economic difficulties, and thus recommends that:

- Employers that have not done well should provide their LWWs with a built-in wage increase at the lower bound of 5.5-7.5% of gross monthly wage. If business prospects subsequently improve, employers should consider further wage increases.

12. The wage guidelines for lower-wage workers will apply to employees who are earning a gross monthly wage of up to $2,200.9 This threshold corresponds to the 20th percentile wage level of the workforce, and ensures that all LWWs continue to receive additional attention under the NWC’s guidelines. In implementing the wage increases, employers should seek to bring about meaningful improvement to employees’ income stability in the long run, and ensure sustained basic wage growth and fair wages for employees based on their hours worked. Employers are also encouraged to tap on the support from the Progressive Wage Credit Scheme. In line with the TWG-LWW’s recommendation to aim for higher wage growth for lower-paid LWWs, the NWC calls on employers to provide higher percentage wage increase for LWWs who are earning comparatively lower wages.

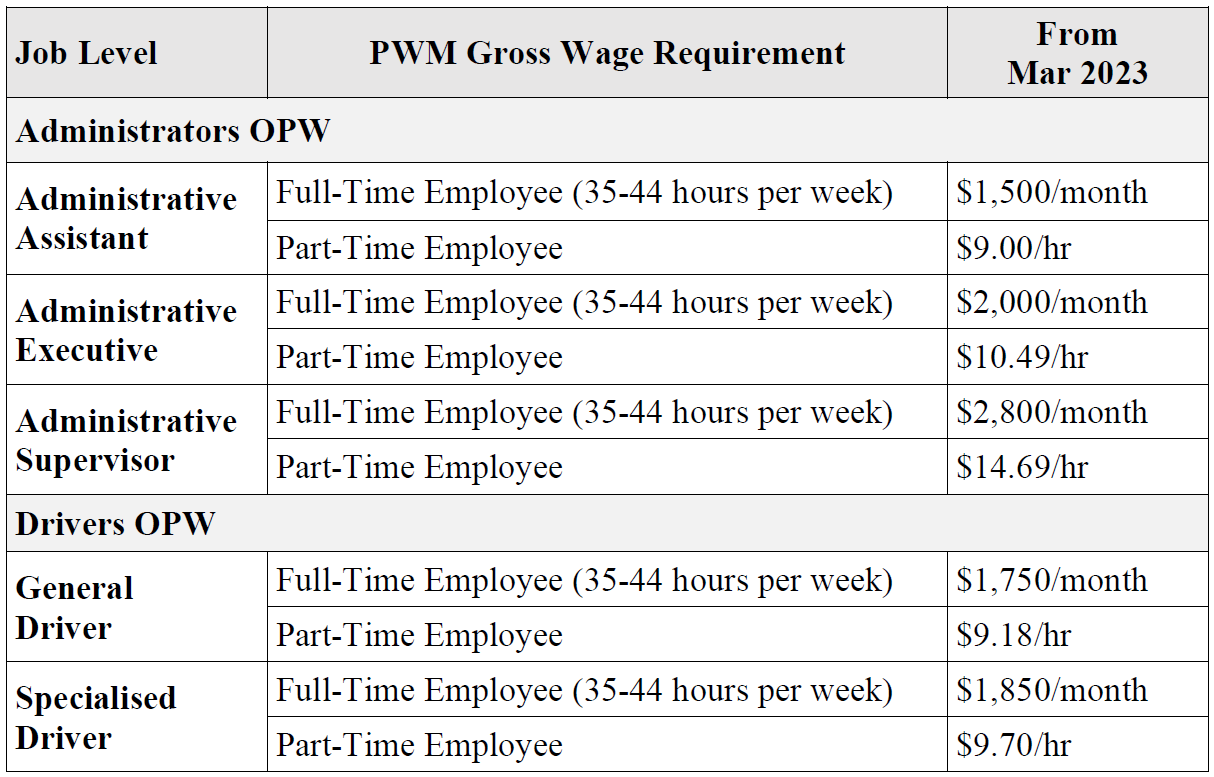

13. Occupational Progressive Wages . The TWG-LWW had earlier announced the introduction of Occupational Progressive Wages (OPW) for resident Administrators and Drivers from March 2023, and released the accompanying tripartite-endorsed Progressive Wage levels (see Annex A ). In addition to the earlier released wage levels for regular working hours, the NWC has endorsed additional overtime wage requirements so that LWWs are assured of fair renumeration when working overtime. The OPW for Administrators and Drivers will benefit about 175,000 full-time resident administrators and drivers in firms that employ foreign workers, of which 56,000 are LWWs.10 Training remains key to improving productivity and ensuring sustainable wage increases. The NWC has thus reviewed the training requirements for OPW (see Annex A ). In the next NWC cycle, the NWC will deliberate and issue the OPW wage requirements for March 2024 and beyond.

Forging Ahead in Transforming Jobs and Upskilling Workforce

14. To ensure that wage growth is sustainable and supported by productivity growth, employers and employees should press on with business transformation and training. The NWC expresses concern that the proportion of employers that provided structured training to employees decreased from 65.4% in 2020 to 57.1% in 2021. The proportion of employees receiving structured training also decreased from 46.5% in 2020 to 45.4% in 202111. Therefore, the NWC calls on employers and employees to take decisive steps to transform jobs and invest in upskilling and reskilling the workforce, with the support of the Government, trade associations and chambers, and unions .

15. The NWC recommends that employers implement training and productivity initiatives .

- Employers are encouraged to work with NTUC to establish Company Training Committees (“CTCs”)[^13]. The CTCs have helped companies in driving business transformation to increase productivity and implementing training plans, and can tap into the wider NTUC training and placement ecosystem, which includes NTUC’s e2i. The Government has also set aside $70 million for the NTUC CTC Grant to support employers to implement transformation plans.

- To ensure skills currency, employers should adopt a proactive approach to reskill and upskill existing employees to prepare them for changes in job functions. Employers and employees can refer to SkillsFuture Singapore (SSG)’s quarterly Jobs and Skills Insights Reports, as well as the Skills Demand for the Future Economy report published in December 2021[^14] to learn about emerging trends, growth areas and in-demand skills.

- Employers can also tap on Government subsidies to reskill and upskill employees, e.g., Workforce Singapore’s Career Conversion Programmes which provide up to 90% of monthly salary[^15] for training duration. Individuals can also tap on the SkillsFuture Mid-Career Enhanced Subsidy, which provides subsidies of up to 90% of course fees[^16] for SSG-supported courses.

- Employers can also seek the assistance of SNEF, Singapore Business Federation (“SBF”), other trade associations & chambers, the unions and NTUC LearningHub, access consultancy services offered by the National Centre of Excellence for Workplace Learning (“NACE”), or join a SkillsFuture Queen Bee network in their sector where available to raise their capability and capacity for training their own workers.

- Employers should also recognise and support the acquisition and demonstration of skills in decisions affecting hiring and career advancements.

16. The NWC also calls on employees to take a proactive approach towards training to ensure currency of skills by staying abreast of skills needs in their sector and the broader economy. Individuals may tap on SkillsFuture initiatives to continuously reskill and upgrade their skills so that they can realise their full potential.12

Implementation of Recommendations

17. These guidelines apply to all employees13 – professionals, managers, executives, technicians, rank-and-file, in unionised and non-unionised firms, in both the public and private sectors. They also apply to re-employed employees.

18. To facilitate wage negotiation, employers should share relevant information, such as company wage information, business performance and prospects, with unions.

19. The NWC encourages employers that encounter difficulties in implementing the guidelines to work with the employers’ associations and unions to address the issues. Small and Medium Enterprises (SMEs) may also approach the three ethnic chambers14 and other trade associations and chambers for guidance in implementing the guidelines.

20. The NWC is confident that our productivity and training efforts will continue to enable sustainable wage growth and a better standard of living for Singaporeans. Our efforts to uplift LWWs will also remain important as we build a strong social compact and an inclusive Singapore that leaves no one behind. The NWC urges all employers, unions, and the Government to continue working together to secure a brighter future for all.

Annex A – Occupational Progressive Wage

Wage requirements from March 2023

For full-time employees working overtime and are covered by Part 4 of the the Employment Act, employers will also need to comply with the overtime gross wage requirements detailed on MOM’s website.

Note: The PWM gross wage requirement for full-time employee (35-44 hours per week) excludes wages paid for overtime work, but includes the basic wage and gross wage components such as allowances (including travel, food, housing) and productivity incentive payments. It also excludes bonuses (e.g. Annual Wage Supplement), stock options, reimbursement of special expenses incurred in the course of employment and payments-in-kind as well as employer CPF contributions. It is before the deduction of employee CPF contributions. Details on each Occupational Progressive Wage job role and overtime wage requirements can be found at: https://www.mom.gov.sg/employment-practices/progressive-wage-model/expansion-of-progressive-wage-approach-and-coverage

Training requirements from March 2023

Employers are required to ensure that all resident OPW employees attain either:

- One Workforce Skills Qualifications (WSQ) course, with no restriction on which course can be taken, or;

- One in-house training programme

- An in-house training programme refers to a training programme organised by employers themselves and guided by defined training objectives, training modality, key training tasks, and training duration.

- Where required, employers should be prepared to show supporting documentation on the in-house training programme – (i) defined training objectives, (ii) training modality, (iii) key training tasks, (iv) training duration (e.g. no. of days) – and records of specific workers undergoing the training.

- On-the-job training can be counted towards in-house training programme requirement, as long as it fulfils the criteria set out above.

Employers will be given a grace period to comply with the OPW training requirements:

- For new hires, employers are to comply within a grace period of six months from the new hire’s date of employment.

- For existing employees, employers are given a grace period of one year from the start of the OPW implementation in March 2023 (i.e. up to 29 February 2024) to comply with the training requirement.

Footnotes

-

The advance GDP estimates for the third quarter of 2022 are computed largely from data in the first two months of the quarter (i.e., July and August 2022). They are subject to revision when more comprehensive data become available. ↩

-

Exceptions include the construction, retail trade, transportation & storage, accommodation, food & beverage services, and administration & support services sectors. These sectors’ real value-added remained below their pre-COVID (i.e., third quarter of 2019) levels in the third quarter of 2022. ↩

-

MTI will announce Singapore’s 2023 GDP growth forecast in November 2022. ↩

-

The variable components should comprise 30% of the basic wage package on an annual basis (10% for the Monthly Variable Component and 20% for the Annual Variable Component, inclusive of the Annual Wage Supplement) for rank-and-file employees, 40% for middle management and 50% for senior management. ↩

-

The first set of Progressive Wage moves consists of the new Local Qualifying Salary requirement, the Retail Progressive Wage Model (PWM) and the extension of the PWM to in-house cleaners, security officers, and landscape workers. The second set of moves consists of the Food Services PWM and the Occupational Progressive Wage for Administrators and Drivers. In addition, the Waste Management PWM will be implemented in July 2023. ↩

-

For 2022, the scheme will co-fund wage increases for resident LWWs by up to 75%. The average gross monthly wage increase must be at least $100 to be eligible for the co-funding. ↩

-

The minimum dollar quantum increase ensures that the lowest-paid LWWs receive a meaningful increment. ↩

-

The range of wage growth for LWWs recommended in the NWC 2021/2022 guidelines was 4.5%-7.5%. The Tripartite Clusters for Retail and Waste Management endorsed wage increases for PWM employees of 8.4%-8.5% p.a. and 6.4%-8.1% p.a. respectively. ↩

-

For part-time employees, the NWC’s recommendation on the percentage range of wage growth for LWWs, but not the minimum dollar quantum, will apply. ↩

-

Refers to full-time resident employees earning a gross monthly income from work (excluding employer CPF) up to and including the 20th percentile income level of full-time employed residents (excluding employer CPF), which was $2,200 in June 2021. Source: Comprehensive Labour Force Survey and Administrative Records, Manpower Research and Statistics Department, MOM. ↩

-

Data on training incidence pertain to private sector establishments each with at least 25 employees. Source: Employer Supported Training Survey, Manpower Research & Statistics Department, MOM. ↩

-

Details on SSG’s initiatives can be found at: www.skillsfuture.gov.sg/ProgrammesForYou. ↩

-

This includes full-time and part-time employees. ↩

-

The ethnic chambers are the Singapore Chinese Chamber of Commerce and Industry, Singapore Malay Chamber of Commerce and Industry, and Singapore Indian Chamber of Commerce and Industry. ↩